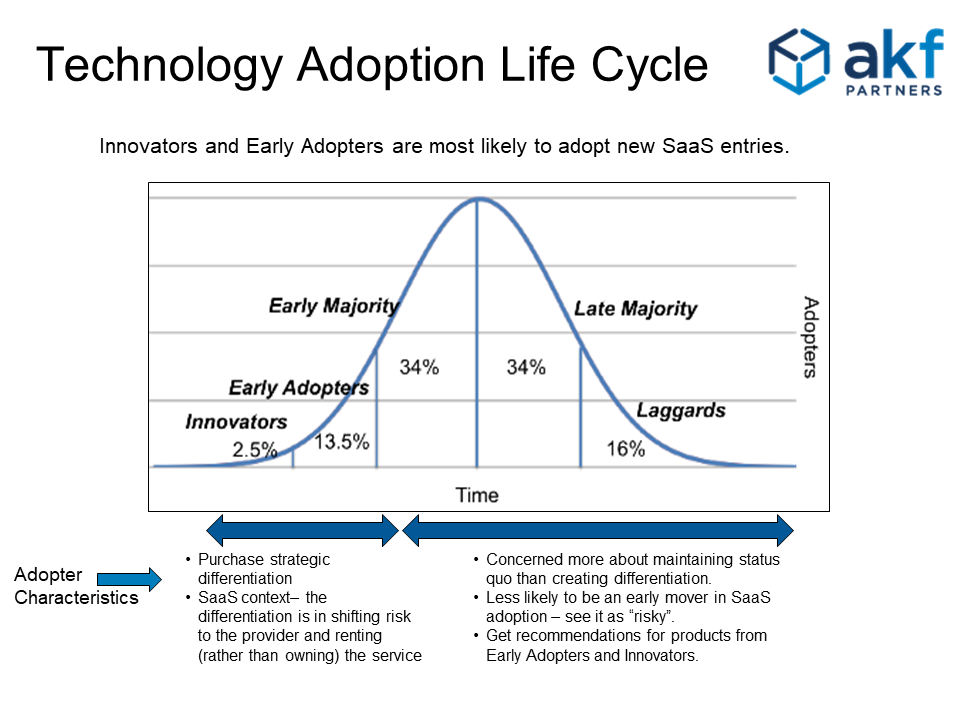

XaaS (e.g. SaaS, PaaS) mass-market adoption is largely a demand-side “pull” of a product through the Technology Adoption Lifecycle (TALC). One of the best books describing this phenomenon is the book that made the TALC truly accessible to business executives in technology companies, Crossing the Chasm.

An interesting side note here is that Crossing the Chasm was originally published in 1991. While many people associate the TALC with Geoffrey Moore, it’s actual origin is Everett Rogers’ research on the diffusion of innovations. Rogers’ initial research focused on the adoption of hybrid corn seed by rural farmers. Rogers and team expanded upon and generalized the research between 1957 and 1962 when he released his book Diffusion of Innovations. While the 1962 book was a critical success, I find it interesting that it took nearly 30 years to bring the work to most technology business executives.

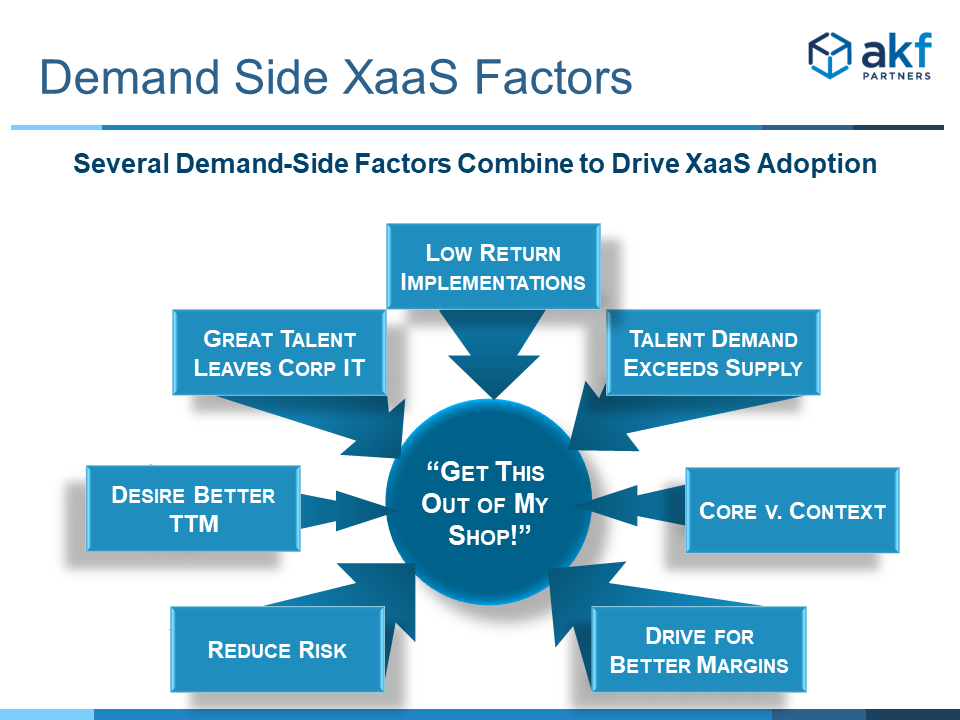

Several forces combine to incent companies within each phase of the TALC to consider, and ultimately adopt, XaaS solutions. Progressing from left to right through the TALC, companies within each phase are decreasingly less aware of these forces and increasingly more resistant to them until the forces are overwhelming for that segment or phase. Innovators, therefore, are the most aware of emerging forces, seek to use them for competitive advantage and as a result are least resistant to them. Laggards are least aware (think heads in the sand) and most resistant to change, desiring status quo over differentiation.

While the list below is incomplete, it has a high degree of occurrence across industries and products. Our experience is that even when they are experienced in isolation (without other demand side XaaS forces), they are sufficient to pull new XaaS products across the TALC.

Demand Side Forces

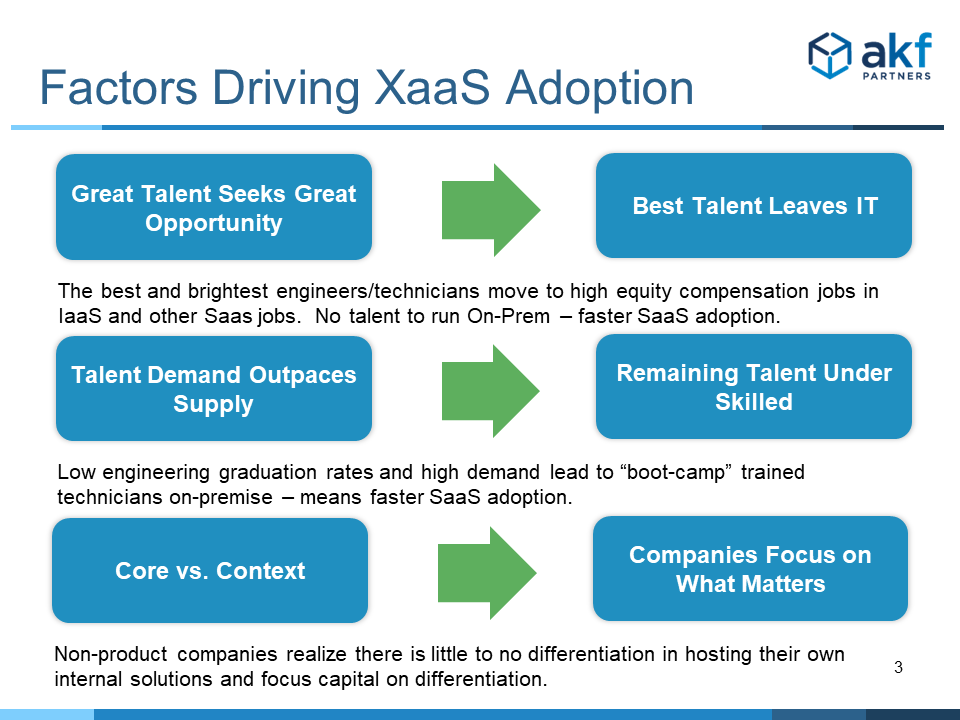

Talent Forces: Opportunity, Supply and Demand

The first two forces represent the talent available to the traditional internally focused corporate IT organization. The rise of XaaS offerings and the equity compensation opportunities inherent to them has been a vacuum sucking what little great talent exists within corporate IT. This first force really serves to add insult to injury to the second force: the initial low supply of talented engineers available in the US.

Think about this: Per-capita (normalized for population growth) US graduates for engineers within the US has remained relatively constant since 1945. While there has been absolute growth, until very recently that growth has slightly underperformed relative to the growth in population. Contrast this with the fact that college graduation rates in 2012 were higher than high school graduation rates in 1940. Add in that most engineering fields were at or near economic full employment during the great recession and we have a clear indication that we simply do not produce enough engineers for our needs. The same is true on a global level.

This constrained supply has led to alternative means of educating programmers, systems administrators, database administrators and data analysts. “Boot Camps”, or short courses meant to help teach people basic skills to contribute to the product and IT workforces, have sprung up around the nation to help fulfill this need. Once trained, the people fulfill many lower level needs in the product and IT space, but they are not typically equivalent to engineers with undergraduate degrees.

Constrained supply, growing demand and a clear differentiation in employment for engineers working in product organizations compared to IT organizations means that IT groups simply aren’t going to get great talent. Without great talent, there can be no great development or operations teams to create or run solutions. As such, the talent forces alone mandate that many IT teams look to outsource as much as they can: everything from infrastructure to the platforms that help make employees more efficient.

Core vs. Context

Why would a company spend time or capital on running third party solutions or developing bespoke solutions unless those activities result in competitive differentiation? Doing so is a waste of precious time and focus. Companies simply can’t waste time running email servers, or building CRM solutions and soon will find themselves not spending time on anything that doesn’t directly lend itself to competitive advantage.

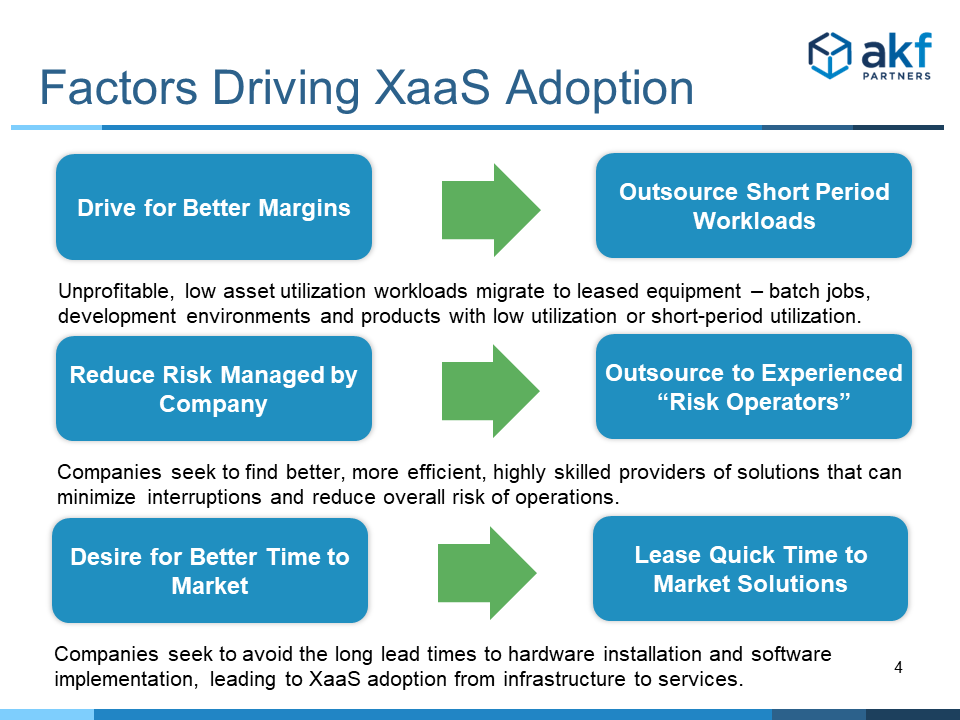

Margins

Put simply, anytime a company can’t maximize profit margins through keeping in-house systems highly utilized, they should (and will) seek to outsource the workload to an IaaS provider. Why purchase a server to do work 8 hours a day and sit idle 16? Why purchase a server capable of handling peak period of 10 minutes of traffic, when a server one fifth its size is all that’s needed for the remainder of the day?

Part of staying competitive is focusing on profit maximization to invest those profits in other, higher return opportunities. Companies that don’t at least leverage Infrastructure as a Service to optimize their costs of operations and costs of goods sold (if doing so results in lowered COGS) are arguably violating their fiduciary responsibility.

Risk

Risk is the probability that an event occurs, multiplied by the impact of that event should it occur. Companies that specialize in providing a service, whether it be infrastructure as a service or software as a service typically have better skills and more experience in providing that service than other companies. This means that they can both reduce the probability of occurrence and likely the impact of the occurrence should it happen. Anytime such a risk shift is possible, where company A can shift its risk of operating component B to a company C specializing in managing that risk at an affordable price, it should be taken. The XaaS movement provides many such opportunities.

Time to Market

One of the most significant reasons why companies choose either SaaS or IaaS solutions is the time to market benefit that their usage provides. In the SaaS world, it’s faster and easier to launch a solution that provides compelling business efficiencies than purchasing, implementing and running that system in-house. In the IaaS world, infrastructure on demand is possible and companies need not wait for onerous lead times associated with ordering and provisioning equipment.

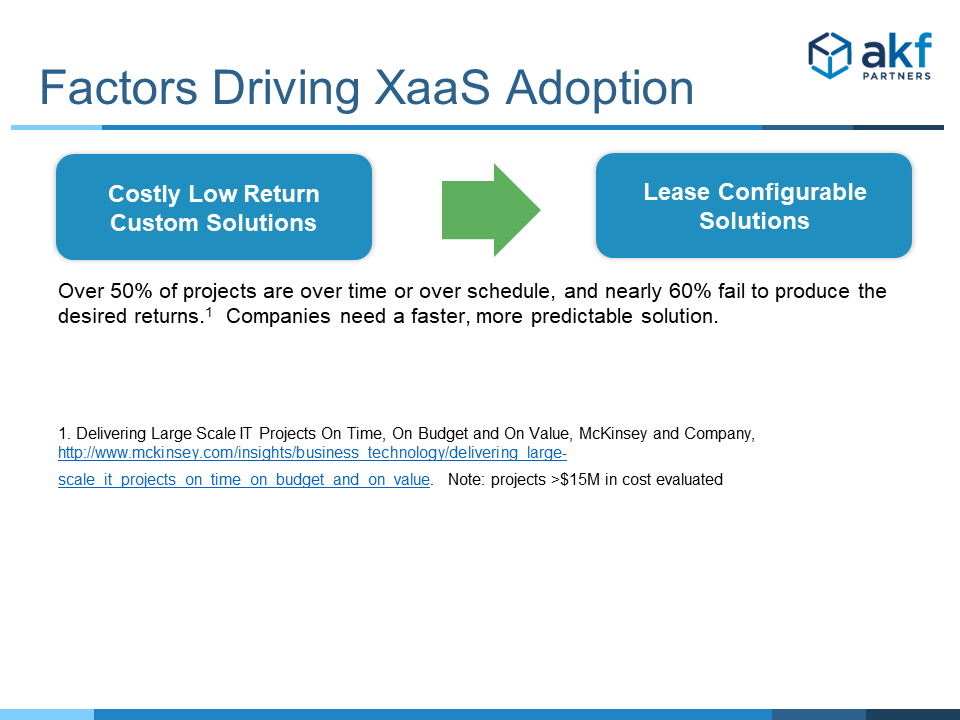

Focus on Returns

Most projects, including packaged software purchased and implemented on site are delivered late and fail to produce the returns on which the purchase was predicated. Further, these projects are “hard to kill”, with millions invested and long depreciation cycles; companies are financially motivated to “ride” their investments to the bitter end in the hopes of minimizing the loss. In the extreme, XaaS solutions offer a simple way to flee a sinking ship: leave. Because the solution is leased, you can (obviously with some work) switch to a competing provider. Capital is freed up in the company for higher return investments associated with revenue rather than costs.

Factor Outcomes

The outcomes of these factors is clear. In virtually every industry, and for nearly every product, companies will move from on-premises or built-in-house solutions to XaaS solutions. CEOs, COOs, CTOs and CIOs will all seek to “Get this stuff out of my shop!”

Companies that believe it will never happen in their industry are simply kidding themselves and completely ignoring the outcomes predicted within the technology adoption life-cycle. Every company needs to focus on fewer, higher value things. Every company should outsource risky operational activities if there is a better manager of that risk than them. Every company is obligated to seek better margins and greater profitability – even those companies in the not for profit sector need to maximize the benefit of every donated dollar. Every company seeks opportunities to bring their value to market faster. And finally, few companies can find the great talent in today’s market necessary to be successful in their corporate IT and product operations endeavors.

If you produce on-premises, licensed software products and have not yet considered the movement to a SaaS solution, you need to do so now. Failing to do so could mean the demise of your company.

We are experts in helping companies migrate products to the XaaS model. Contact us - we would love to help you.

Related Articles: