The Problem – Too Much Planning, Too Little Execution

How many of you spend a significant portion of your year planning for the next year, two years, or five years of activities? How often are these plans useful beyond the first three to four months of execution?

We have many large clients who will begin one, two ,or (gasp!) five-year year plans in July or August of the current year. They spend a significant amount of effort creating these plans over a five-to-six-month span of time. The plans are often very specific as to what they will do; what projects they will deliver, what products they will create, how many people they will hire, what training their teams will undertake, etc. The plan is typically well followed in month 1 and 2 and starts to degrade significantly in month 3. By month 6, just before they start the next annual planning cycle, the original plan is at best 50% accurate; the original projects have been replaced, new market intelligence has informed different product solutions, new skills and different teammates are needed, etc.

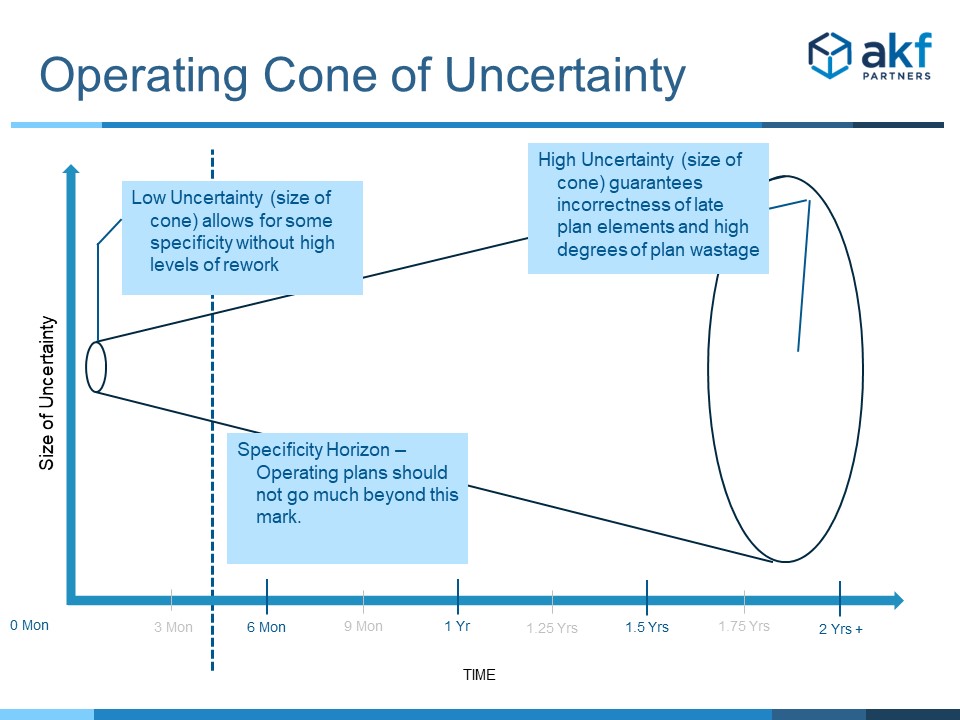

Hurricanes always have an associated cone of uncertainty. The current position of the hurricane and current direction and velocity are well known. But several factors may cause the hurricane to act differently an hour or a day from now than it is behaving at exactly this moment. The same is true with businesses. We know what we need to do today to maintain our position or gain market share, but those activities may change in priority and number in the next handful of months.

So why do we spend so much time on solutions and approaches when at best 25% of the plan we produce is accurate? We don’t have to waste time as we do today, there is a better way.

Financial vs Operational Plans

First, let’s acknowledge that there is a difference between a financial plan (how much we will spend as a company and what we expect to make as a return on that spend) and an operational plan. The board of directors for your company has a fiduciary responsibility to exercise, in non-expert legal terms:

- A duty of loyalty – the director must put the interests of the institution and its shareholders before his or her own.

- A duty of care – the director must behave prudently, diligently and with skill.

- A duty of obedience – the director must ensure consistency with the purpose of the company – and in a for-profit company, this means ensuring profitability.

Any board of directors, to ensure they are consistent with the law, will require a financial plan. At the very least, they need to govern the spend of the company relative to its revenues to ensure profitability, and ideally over time, an increase in profitability. But that does not mean they need to go into great detail regarding the exact path and actions to achieve the financial plan. We all likely agree that we also have a duty of loyalty, care, and obedience to ourselves and our families – but how many of us go beyond creating an annual budget (financial plan) for any given year?

One of the best known and most successful directors and investors of all time, Warren Buffett, has what amounts to be (in another authors terms) a list of “10 Commandments” for boards and directors. A quick scan of these makes it clear that Buffet’s perspective for board’s focus should be on the performance of the CEO and the company itself – not the detailed operational plan to achieve a financial plan. The board does arguably need to ensure that a strategy exists and is viable – but a strategy need not be a list of tasks for every subordinate organization for an entire year. In fact, given the arguments above, such a task list (or deep operational plan) won’t be followed past a handful of months anyway.

The Fix: Reduce Planning, Increase Execution

If the problem is too much time wasted creating plans that are good for only a short period of time, the fix should be obvious. For this, we offer the AKF 5-95 Rule: spend 5 percent of your time planning and 95% of your time executing. This stands in stark contrast to the “Soviet-esque” way in which many companies operate with executives spending as much as 25 percent of a year involved in financial and execution plans.

- Decrease the horizon (focused endpoint) of planning and decrease the specificity of plans. Take a portion of the five percent of your total time and create a good financial plan of what you would like to achieve. The remainder should be used to iteratively identify the short-term paths to achieve that plan using windows no greater than 3 months. Anything beyond 3 months has a high degree of waste.

- Adopt development methodologies that maximize execution value. Adopt Agile development methodologies meant to embrace low levels of specificity and rely on discovery to identify the “right solution” to maximize market adoption.